Depreciation value is calculated by the formula

Straight line depreciation is the. Consider a piece of equipment that costs.

Declining Balance Depreciation Double Entry Bookkeeping

Straight-line depreciation is the most commonly used method of depreciation.

. It includes taxes paid or shipping. A company buys a computer for 2000 that has a useful lifespan of five years and its estimated salvage value after five years is 500. Having calculated the liabilities and total.

It is the initial book value of the asset. The formula is as under. Fair value at the start of the year.

Returns the depreciation of an asset for a specified period using the double. How To Calculate Book Value 13. The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life.

Asset cost - salvage valueestimated units over assets life x actual units made. As the name suggests it counts expense twice as much as the book value of the asset every year. You can use the following basic declining balance formula to calculate accumulated depreciation for years.

Depreciation is handled differently for accounting and tax. S P1 - iY Where P. Calculating Depreciation Using the Units of Production Method.

Depreciation is calculated by comparing the market fair value of assets at the start and end of the year. With the straight line depreciation method the value of an asset is reduced uniformly over each period until it reaches its salvage value. Depreciation Expense Cost Salvage value Useful life.

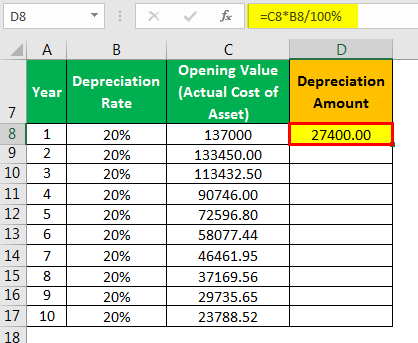

Calculate the net fixed assets. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Depreciation Value per year Cost of Asset Salvage value of Asset Depreciation Rate per Year.

Depreciation 2 Straight line depreciation percent book value at. Depreciation Formula for the Straight Line Method. To determine straight-line depreciation for.

Annual Depreciation Expense Cost of the Asset Salvage Value Useful Life of the Asset. This article describes the formula syntax and usage of the DDB function in Microsoft ExcelDescription. Total yearly depreciation Depreciation factor x 1.

Use the information you gathered and the formula to calculate the net fixed assets. Depreciation per year Book value Depreciation rate. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae.

Depreciation Rate Formula Examples How To Calculate

Car Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Depreciation Calculator

Straight Line Depreciation Formula And Excel Calculator

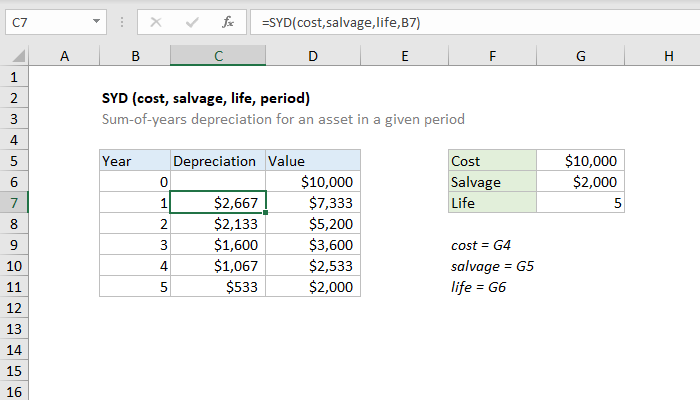

How To Use The Excel Syd Function Exceljet

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Calculation

How To Calculate Book Value 13 Steps With Pictures Wikihow

Depreciation Of Fixed Assets Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

How To Use The Excel Db Function Exceljet